Second District, Division 4 Orders Denial of Motion to Tax Costs.

Civil Code section 1717 applies to fee award requests, not an award of routine costs. If a memorandum of costs itemizes routine costs authorized by statute (such as filing fees, process service fees, and exhibit copying expenses), the burden is on the party seeking to tax these costs to show they were unnecessary or unreasonable in nature. (Nelson v. Anderson, 72 Cal.App.4th 111, 131.) Defendant failed to meet that burden in the next case, although a motion to tax was erroneously granted anyway under Civil Code section 1717 (with no mention of passing on the “unnecessary/unreasonable” objection).

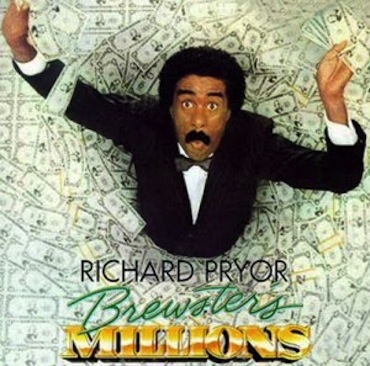

The Court of Appeal in Blackshear v. Brewster, Case No. B220960 (2d Dist., Div. 4 Sept. 23, 2010) (unpublished) corrected that error and also refused to remand because the back-up objection lacked merit.

In Blackshear, following a dismissal without prejudice in favor of defendant—which usually triggers an award of routine costs—defendant filed to recover $474.85 in costs consisting of filing fees, process service expenses, and exhibit copying disbursements. Plaintiff moved to tax costs on two grounds: (1) Civil Code section 1717 and the Santisas rule applied (voluntary dismissal of contract action means no 1717 exposure); and (2) the claimed costs were unnecessary. The trial court granted the motion to tax “pursuant to Code of Civil Procedure [sic—should have been Civil Code] section 1717.” Defendant appealed.

The appellate panel decided that Civil Code section 1717 did not apply to the case. Section 1717 only applies to a contractual fee provision, and the contract in the underlying case had no fee clause. Beyond that, the standard for “prevailing party” under Code of Civil Procedure section 1032 (the costs provision) is different from the “prevailing party” standard for an award of attorney’s fees. (Chinn v. KMR Property Management, 166 Cal.App.4th 175, 190 (2008).) A defendant in whose favor a dismissal has been entered, whether with or without prejudice, is entitled to costs. (Cano v. Glover, 143 Cal.App.4th 326, 331 (2006).)

With respect to the argument that costs were unnecessary, the appellate court found it to be meritless such that a remand was not in order to determine the merits of the secondary objection. The burden is on the party seeking to tax costs to show that they were unnecessary or unreasonable in nature, a burden not met by plaintiff. More than a simple disagreement with the itemized costs is necessary to meet the appropriate burden. (Nelson v. Anderson, supra, 72 Cal.App.4th at 131.)

Motion to tax costs grant reversed with directions that the lower court enter a new order denying the motion.