Had Requested $778,535, But Court Rejected the Request.

As reported by Ryan Abbott in an October 5, 2012 post at Courthouse News Service, Winston Strawn attorney Ernest Fleischer saved shareholders of defunct S&L Benj. Franklin Federal Savings and Loan Association a huge amount of taxes–cutting a $1.2 billion tax IRS claim down to $50 million. In return, Winston Strawn sued the FDIC, receiver of the S&L, claiming it should pay a demand of attorney’s fees for 2% of the $43.5 million surplus left or, alternatively, twice the hourly fees plus fees incurred to file the motion. (Obviously, there would have been no surplus left if the tax claim stayed intact.)

U.S. Chief Judge Royce Lamberth (D.C.) denied the request, finding that the $89,465.34 already paid by the FDIC for the work was sufficient, with the attorneys not entitled to a surplus percentage, a positive multiplier, or fees on fees.

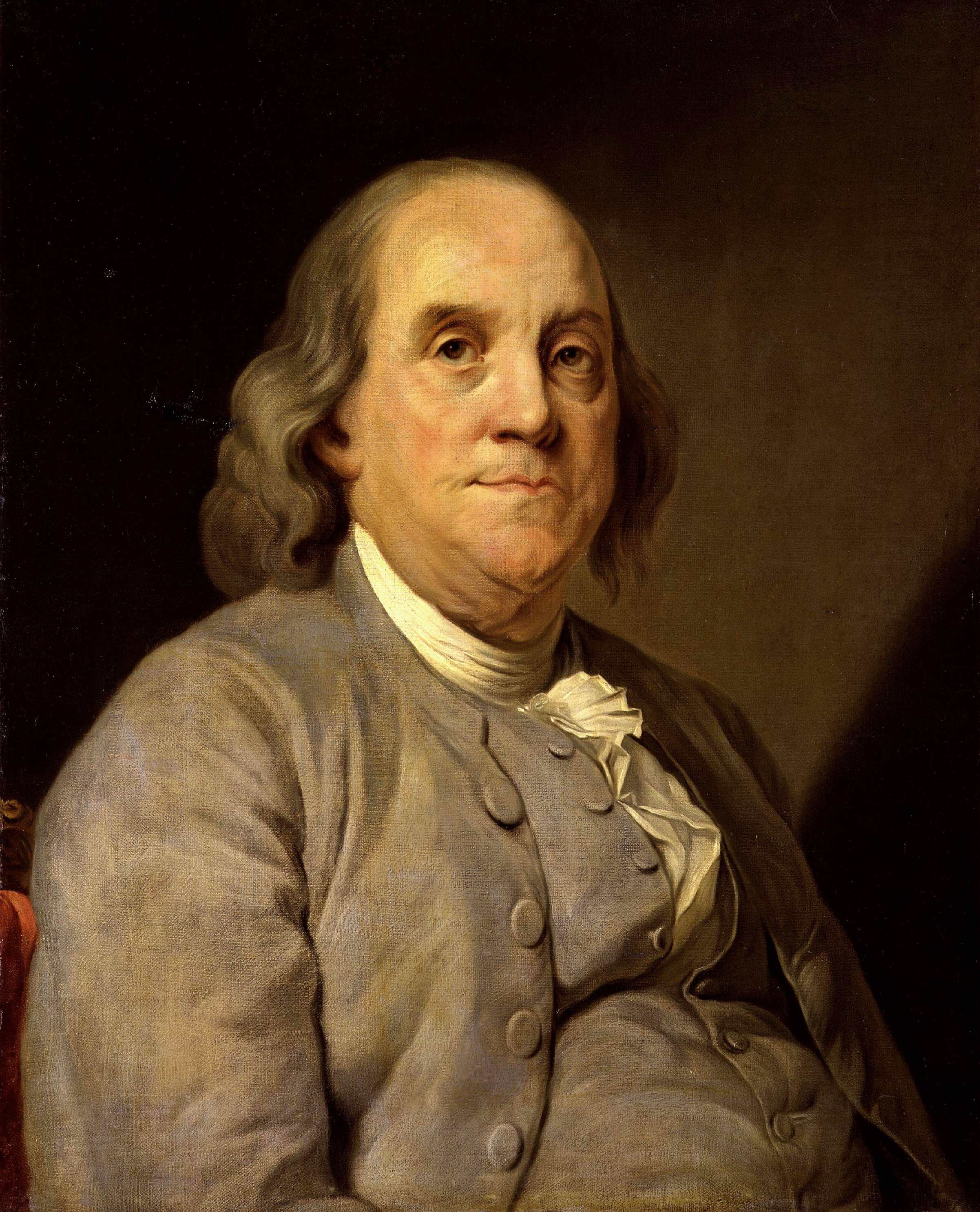

“A penny saved is twopence dear.” Poor Richard’s Proverbs. (Often misquoted as “A penny saved is a penny earned,” according to Wikipedia article on Benjamin Franklin.