Lower Court Jurist Understandably Made a Mistake Given “Bleak House” Type of Litigation; Unopposed Motion Became Opposed Through Invited Error.

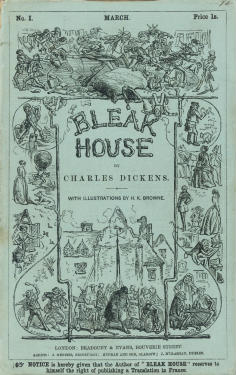

Even the trial court in Pemstein v. Pemstein, Case No. G047107 (4th Dist., Div. 3 Nov. 6, 2013) (unpublished), following many lawsuits, two bankruptcies, and four appeals, hoped that his ruling on a motion to tax costs “hopefully conclude[d] the final state of this 21st century ‘Bleak House’” in a complex and bitter partnership dissolution between two brothers. Not quite, but close.

Because the dispute started in the early 2000s, and involved confusingly bifurcated proceedings, the lower court–who was not the original judge presiding over the matter–allowed one of the brothers to oppose what was an unopposed motion to tax costs of other prevailing brother. Eventually, the jurist below awarded prevailing brother $107,292.56 in costs, despite the fact that an earlier 2005 judgment had said each party was to bear their own costs.

Upon review, the appellate court reversed and remanded, understanding quite clearly why the protracted battle engendered confusion on the lower court’s part. The main reason for reversal was to give credence to the 2005 judgment which precluded an award of some earlier costs, which was somewhat of a hollow victory for the appealing brother. The appellate court did find that previous 2005 judgment did not prevent an award of costs to the prevailing brother for winning the 2010 accounting dispute. So, the cause was remanded to allow a recalculation of costs based on the 2010 judgment and, not surprising to us, the appellate court found “each side shall bear their own costs on appeal” in the interests of justice.

Also, the reviewing court, in a 3-0 decision authored by Presiding Justice O’Leary, found no error in the lower court’s considering opposition to what was an earlier unopposed motion to tax costs because the parties did allow the matter to be submitted based upon additional briefing which meant the lower court’s ruling on this basis was in effect invited error.